*This is a sponsored post in behalf of LifeLock, however all thoughts and opinions are my own.

I was covered by Obama Care thru Covered California and chose Anthem Bluecross as my health insurance provider. I was set and ready to designate my PCP (Primary Care Provider) in February when I decided to call their customer service hotline to ask a few questions regarding my plan and coverage.

I was filled with shock (and terror) upon hearing a recorded message on the other line which informed that the Anthem Bluecross system was hacked (cyber attacked), that some personal information may be compromised. There were instructions on what to do just in case you feel that your information/account might be at risk. Right there and then, I felt that my mind went on a whirl, identity theft again? I have shared before how my husband had been a victim of fraud identity and how we nearly almost owed a few thousand dollars over phones and services we didn’t use.

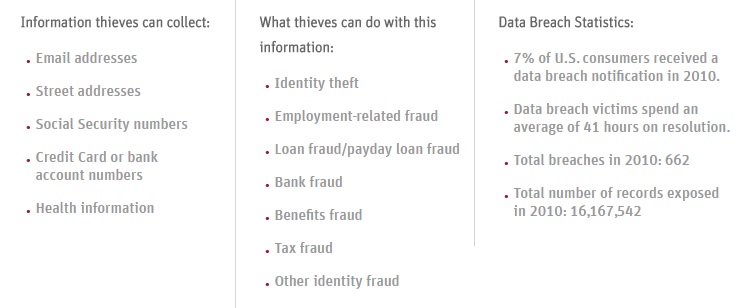

A data breach occurs when confidential information, like your Social Security number, credit card number or health information, is exposed or accessed by an unauthorized person. Businesses need to be handling such information in line with data protection laws to make sure they are not putting their customers’ sensitive data at risk of being breached or accessed by the wrong people – navigate to this web-site to learn about the audits that can be conducted to ensure that data is stored and processed without any weaknesses that could be exploited. It is thus important that businesses have a cybersecurity company who can assist them to protect the data stored by them.

This is one sad but true reality, since we tend to do more things online, Internet identity theft is a growing-and very costly-problem and by all means we should learn the best ways to protect ourselves. Those whose personal information has been leaked to the internet may have been victims of doxxing and could use lawyers to counteract this attack on their privacy.

Tips to Protect Yourself Online

- Guard Your Personal Information

Only use legitimate sources of contact information to verify requests for information, (ex: your financial institution’s official website or the telephone number listed on statements). Never respond to requests for personal or account information online (or over the phone) most especially when your social security number is requested for identification.

Studies show that individuals who receive a data breach notification letter are more than four times as likely to become victims of identity theft. In addition, average out-of-pocket costs are over 200% higher for victims of data breach.

- Don’t Share Too Much

Don’t divulge pertinent information such as birth date, mother’s maiden name, pet’s name or any other identifying information on social media such as Facebook, LinkedIn or Twitter.

- Get as Much Knowledge as Possible

With the help of the wide array of Internet Tips that are out there for us to read, it has never been easier to gain as much knowledge as possible, especially when it comes to the online safety of not only ourselves, but also our loved ones. These tips range from learning how to prevent our iPhone’s from being tracked, to how to secure your webcam, and how to secure your personal information. So, when you have the time, you should make sure that you look at these tips and take in as much information as possible.

Restrict Access

Always use unique and hard-to-guess passwords, if possible use different passwords on different online accounts. Make sure to access ONLY secured websites especially when using public Wi-Fi. ??

- Keep a Close Eye on Your Finances

Regularly monitor bank and credit card accounts. If you can sign up for alerts to be sent to mobile phone or e-mail to monitor your credit and public information online to spot unauthorized activity.

LifeLock can help. The new LifeLock Ultimate Plus program offers several new activity alerts that add peace of mind against identity fraud in a digitally connected world.

LifeLock members benefit from proactive alerts that scan our financial network to help identify potential threats before damage can be done. LifeLock’s patented alert technology gives you the opportunity to confirm your identity before a new account such as a retail card, auto loan or new wireless phone is opened with your information. In the event that identity theft occurs, LifeLock provides award-winning resolution support and a $1 Million Total Service Guarantee

- Beware of Fake Online Sweepstakes and Contests

Take the time to check out the validity of an offer. Remember that all offers that require payment or private information before giving an award are bogus! Collect the contact information from the sender and details about the company running the contest. Most scammers are turned away once you start to ask a lot of questions.

How can you protect yourself if you were a victim of a security breach such as the Anthem example from last month?

As much as I love the online world, online security can be tricky. I try to make my passwords as complicated as possible, and yes always look at your statements for unusual activity.

So scary! I love the online world, but I do worry if I am being safe enough! I can't imagine having my identity stolen! Thank you for the great tips and refreshing msg!

It can be so scary with the things that can happen online. There's so much that is good about the online world, but sometimes we're all too free with what we share and forget how dangerous that can be.

I need this bad – I live online and always freak out that something might happen

My info has been exposed in two separate security breach incidents. Fed up, I signed up for LifeLock and feel much more confident about my personal info now.

Been on the same boat and it really feels scary! Good thing you trusted Lifelock!